Last week we announced our Credit Union Mortgage Dashboard, where we’ve been tracking daily mortgage rates from over 125 credit unions and comparing them against the national average, with the best CU APRs consistently beating the FRED benchmark by 0.5% (That’s 50 ”basis points” in finance talk).

What happens when we compare CUs against the “Big Four” banks: Chase, Wells Fargo, Bank of America, and US Bank?

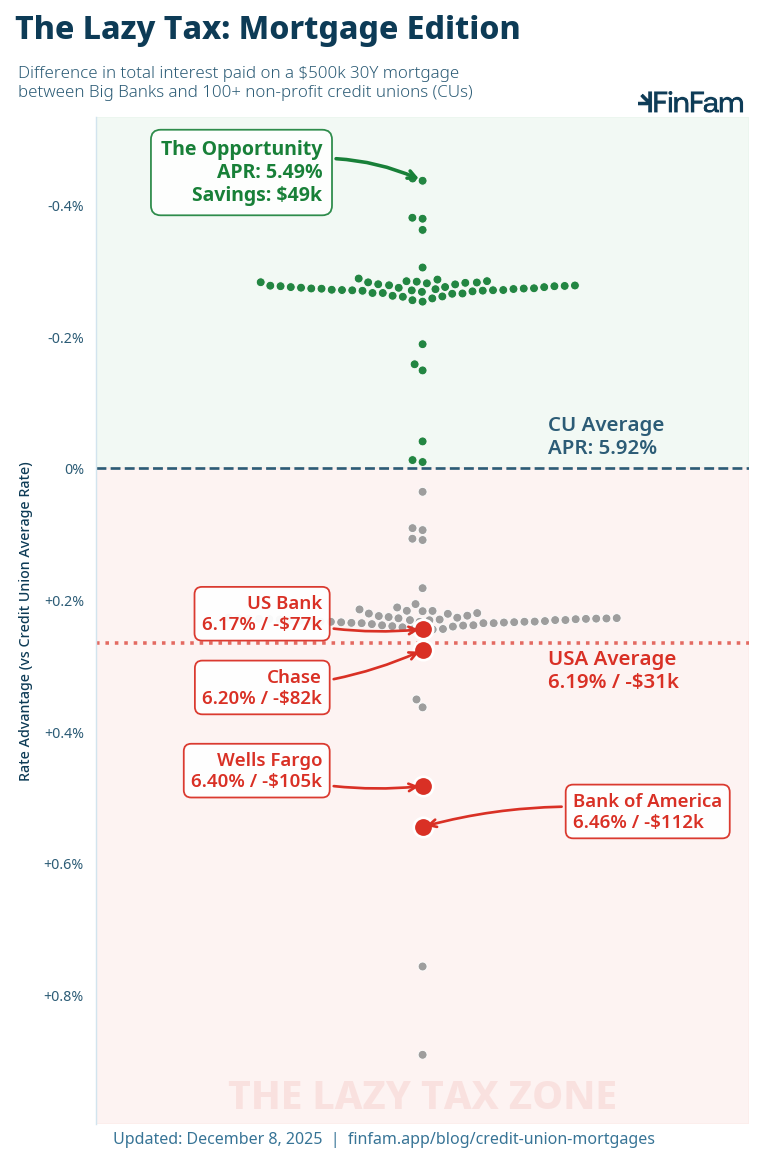

Be forewarned: depending on which bank you use, this chart might look less like a swarm plot and more like a crime scene.

The Lazy Tax: Mortgage Edition

Better rates with higher savings are higher on the chart. The green and gray points are our sampling of credit unions. We’ve highlighted big bank rates in red, because on average they were 30 to 50 basis points (0.3% - 0.5%) worse than the credit union average.

Some call it the “Loyalty Tax”, others call it the “Lazy Tax”. Either way, this difference is the premium consumers pay for sticking with their existing bank instead of shopping around.

If you’re a FTHB (First-Time Home Buyer), 0.5% might sound small. Here’s why it isn’t.

The $50,000 Premium

On a standard $500,000 mortgage over 30 years:

- Credit Union Average (5.92%): Total interest = $569k

- Big Bank Average (~6.42%): Total interest = $628k

That is a $59,000 difference. As in, $170 per month on the average house in the USA, as much as the average household spends on streaming + phones. Easily 3x that if you’re in a VHCOL area.

Why Are Banks So Expensive?

It’s tempting to think the big banks offer a better product. They often have better apps, and in some cases they might close a mortgage faster.

But as Patrick McKenzie noted in Bits About Money, a mortgage is a commoditized manufactured product. The “conforming loan” you get from a local credit union is legally identical to the one from Chase.

So what are you paying for?

When you see a Chase Super Bowl ad, get a Bank of America email, or find a glossy offer from Wells Fargo in your mailbox, you are looking at the reason your rate is higher. Big banks have massive customer acquisition budgets. Banks spend billions to be the “default” option for customers who feel loyalty toward “their” bank. So in very real terms, bank customers pay to be advertised to.

Credit unions are non-profits. They don’t run national TV campaigns. Their marketing plan looks more like a booth at a local community fair than a Super Bowl ad.

The Cost of Convenience

The “Lazy Tax” happens because mortgage shopping is hard.

Many lenders put their rates behind long forms and will spam you to get your business.

Big banks know that if you already bank with them, you’re likely to just click the “Get a Quote” button in your app. It’s easy. It feels safe.

We built the Credit Union Mortgage Dashboard to lower the friction of shopping around. No signup, no ads, no referral fees. Just rates from 125+ institutions in one place, filterable by your state and eligibility.

How to Avoid Paying the Lazy Tax

- Check the Dashboard: Use our tracker to find CUs you are eligible for. We’re not affiliated, we just like data.

- Get at least 3 Quotes: Get one from your primary bank (the baseline), one from an independent mortgage broker, and one from a credit union you’re eligible for.

- Make Them Fight: Take your best CU quote and send it to your bank. Ask them to match it. Often, they have “retention” desks that can magically find rate discounts when they know you’re looking at your options.

Don’t let convenience cost you.

More to Come

We’re only halfway through our credit union deep-dive, and so far we’re only looking at rates. In upcoming posts, we’ll be going deeper into the advantages and disadvantages of credit union mortgages.

Be sure to subscribe to the newsletter below to get notified when new posts drop. In the meantime, feel free to check out the Reddit discussion thread on the infographic above.